Property Tax/Rent Rebate Services

Pennsylvanians age 65 and older; widows and widowers age 50 and older; and people with disabilities age 18 and older may be eligible for a Property Tax/Rent Rebate if they meet certain eligibility requirements.

Looking to apply on your own?

The easiest and fastest way is to apply online. You can apply online HERE.

You can apply via the mail but be aware it does take longer to process and can delay getting your money back. To apply by mail, follow these steps:

- Use this form to apply for the Property Tax/Rent Rebate Program by mail.

- Once completed, mail your claim form, proof of income, and other required documentation to:

PA Department of Revenue

Property Tax/Rent Rebate Program

P.O. Box 280503

Harrisburg, PA 17128-0503

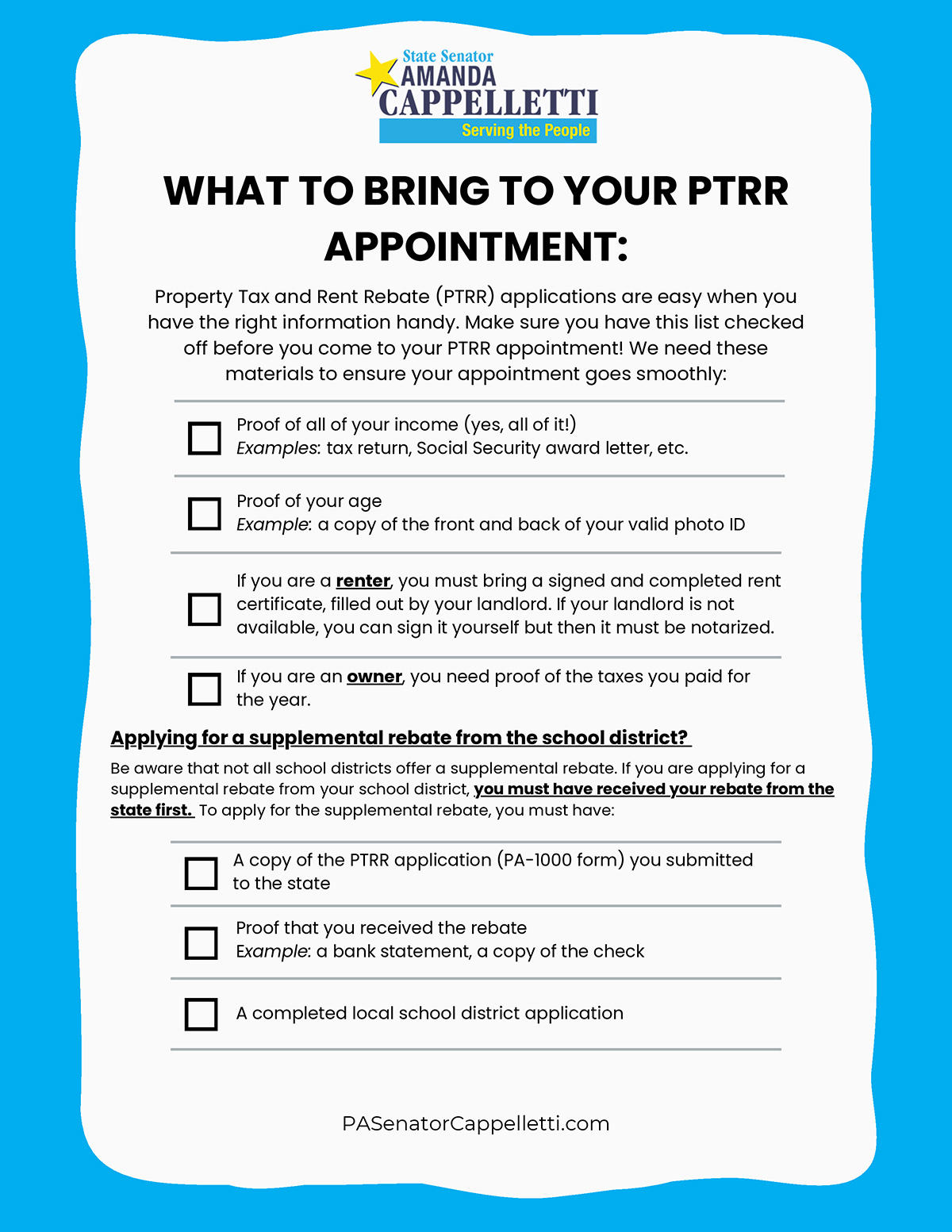

To ensure the fastest processing time, please follow these instructions:

- Do not staple your documents.

- Sign the claim form.

- Submit all necessary documents, including tax receipts for property owners and PA-1000 RC for renters.

- If you are a first-time filer, include proof of age and/or permanent disability.

- Place your completed claim form and necessary documents in the envelope.

Are you looking to apply for a supplemental rebate from your school district?

Some school districts in the region offer supplemental rebates to residents, meaning you can get more money back!

Be aware that not all school districts offer a supplemental rebate. If you are applying for a supplemental rebate from your school district, you must have received your rebate from the state first. In District 17, these school Districts are currently offering rebates: